By Daniel W. Bernadett, P.E., Global Director of Wind Engineering, ArcVera Renewables, a Bureau Veritas Company

Producing green hydrogen efficiently and affordably offers significant challenges for developers. One of the most critical aspects of green hydrogen production is how renewable energy sources like wind,solar and battery storage are combined to power the electrolyzers used to generate hydrogen. Every location has different wind and sun characteristics, and some projects goal-seek a certain percent utilization with green electricity on an hourly, or even sub-hourly basis.

Surprisingly, the simple logic of “more is better” does not apply here. Careful consideration of sizing and how renewable energy sources correlate based on site-specific meteorology and accurate resource characterization in, at least, hourly increments over several years is essential to optimizing both hydrogen production and capital expenditure (CAPEX).

The Cost of Electricity in Green Hydrogen Production

Generally speaking, one-half to two-thirds of the cost of producing green hydrogen comes from the electricity required to power the electrolyzers. Therefore, producing green hydrogen affordably relies heavily on minimizing electricity costs. While it may seem logical to maximize renewable energy generation given the free source of fuel and green hydrogen incentives, this approach is usually financially inappropriate.

To help minimize the cost of green hydrogen, developers should focus on sites where wind and solar resources complement each other – when wind energy production is high, solar is low, and vice versa. This ensures that electricity is produced in concert with the hourly, daily, and seasonal variations of resources for locally optimized and consistent electrolyzer operation, maximizing green hydrogen output and minimizing cost. By optimizing the mix of wind and solar and efficiently matching energy generation to the electrolyzer’s needs, developers can enhance project performance and cost-effectiveness. Additionally, in the US, leveraging tax incentives like the Production Tax Credit (PTC) and the Investment Tax Credit (ITC) can further improve project profitability.

In other words, we find that combining wind and solar energy to site-specifically balance out fluctuations in power generation over time is far more effective than simply increasing the amount of available energy. Depending on the meteorological characteristics of the wind and solar resource at a given site, the proper project sizing varies. There are many other design and commercial factors relevant to the optimization exercise. This paper does not address those details and focuses on two case studies in different parts of the United States where the wind and solar resource differences demonstrate the main point: that location matters when it comes to the complementarity of wind and solar energy.

The Role of Correlation in Hybrid Plants

In hybrid plants (using both wind and solar), how these two energy sources correlate significantly impacts electrolyzer utilization. Sites where wind and solar power output are highly correlated tend to have periods where both sources produce either too much or too little power, leading to inefficiencies in electrolyzer utilization. Uncorrelated sites, however, where wind and solar complement each other, allow for more consistent electrolyzer operation and higher hydrogen production for the same capital investment. Correlation coefficient alone is not sufficient to characterize the impact on hydrogen production. Time-series modeling, hourly or sub-hourly, is crucial since the time-series evolution of the relationship between wind and solar production ultimately determines how much hydrogen can be produced for a particular mix of wind and solar at a given site. The quality, accuracy, and duration of the time series of wind and solar resource data that are used as inputs are a critical factor in generating accurate covariant wind and solar energy outputs on a time series basis.

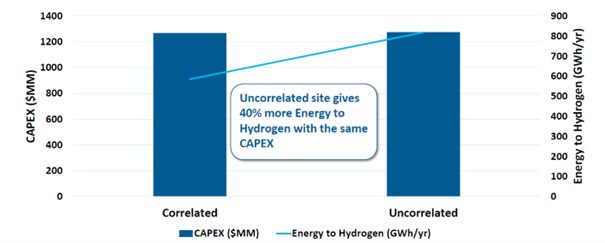

ArcVera’s research shows that uncorrelated sites can produce up to 40% more hydrogen compared to correlated sites with the same CAPEX. This commercially significant difference underscores the importance of selecting sites where renewable energy sources complement each other rather than compete for access to the electrolyzer. Other than meteorological decorrelation of resource characteristics at a given site, geographic diversity is also crucial for achieving this decorrelation, as larger areas have greater meteorological variation and are more likely to consistently produce green megawatt-hours.

Uncorrelated is better: Uncorrelated site gives 40% more Energy to Hydrogen with the same CAPEX

CAPEX Impact When Optimizing Wind and Solar Ratios

Balancing Wind and Solar: To minimize capital expenditure (CAPEX) and maximize hydrogen production, it is important to optimize the ratio of wind and solar energy to match each location’s unique conditions. For example, a site with strong wind resources but weaker solar potential would benefit from a higher wind-to-solar ratio, whereas a sunny location with less wind would require the opposite. Research shows that fine-tuning this ratio can reduce CAPEX by up to 2.3%, resulting in significant cost savings for large-scale green hydrogen projects.

Matching Energy Production to Electrolyzer Size: Another key factor in optimizing hydrogen production is ensuring that the generation capacity of the renewable energy sources is appropriately matched to the size of the electrolyzer. While increased generation can boost electrolyzer utilization, the added CAPEX may outweigh the benefits. Therefore, developers should avoid simply increasing generation capacity, as excessive generation offers diminishing returns. Finding the optimal generation-to-electrolyzer ratio maximizes efficiency of green hydrogen production and minimizes costs.

The Role of Batteries: Another consideration for developers is whether to incorporate battery storage into their hybrid plants to improve electrolyzer utilization. While batteries can improve electrolyzer utilization in hybrid plants by time-shifting excess renewable power generation, their significant cost often outweighs the increased hydrogen production. Studies show batteries are most valuable when electrolyzer utilization is already high, typically in uneconomical generation-heavy configurations. Thus, batteries are generally not cost-effective if generation-to-electrolyzer sizing is optimized, unless project specific requirements override this consideration. If battery prices fall significantly, the financial impact of batteries on a given project would improve.

Green Supply CAPEX: Simple Case Study

ArcVera conducted a case study that focused on co-located wind, solar, and green hydrogen systems. Utilizing the System Advisor Model (SAM) from the National Renewable Energy Laboratory (NREL), the analysis incorporated 8760 hourly wind and solar data sets. These are representative data sets, not a substitute for on-site measurements, and are not suggested for project analysis.

The study compared two sites: a more correlated site in California, known for its sunny conditions, and an uncorrelated site in Texas, characterized by windy weather. The base case involved a 250 MW wind farm, a 250 MW solar farm, and a 250 MW electrolyzer at both locations. The optimal configuration, financially, for the sunny California site was found to be 150 MW of wind and 350 MW of solar, while the windy Texas site showed an optimal mix of 330 MW of wind and 140 MW of solar. This analysis illustrates the importance of optimizing the wind/solar ratio depending on the site-specific wind and solar resource at each site.

Revenue, Modeling, and 45V Compliance

To be financially viable, green hydrogen projects must demonstrate a sufficient internal rate of return, considering various revenue streams and financial modeling strategies. These projects can generate revenue from several sources, including the USA Production Tax Credit (PTC) of about $30 per megawatt-hour (MWh) for green electricity production, a $3/kg Investment USA Tax Credit (ITC) for hydrogen production, regional grid service benefits (especially with battery integration), and hydrogen or hydrogen-product sales. Long-term modeling with accurate sub-hourly time series data, incorporating site specific measurements on meteorological towers, would more accurately reveal upside and downside scenarios across various timeframes. Thus, accurate input time series data is important to accurate financial modeling and is far superior to traditional TMY modeling, which involves significant simplifying assumptions by averaging out natural variation and mischaracterizing site-specific actual covariance of wind and solar resource.

To qualify for tax credits under Internal Revenue Code Section 45V, US green hydrogen projects must meet three key requirements:

1) hour-by-hour matching of hydrogen production with renewable energy generation starting in 2030 (new guidance from regulators)

2) incorporate new renewable energy sources developed within three years of the hydrogen facility

3) location within designated geographic regions with sufficient renewable energy potential

Meeting the hourly matching requirement necessitates a multi-dimensional approach to renewable energy integration, such as utilizing geographically and meteorologically diverse wind and solar sites (or time-stamped wind and solar energy virtual power purchase agreements) with complementary generation profiles, leveraging diurnal variations, strategically positioning solar arrays and wind farms, taking advantage of design variations to improve covarying total green production, and capitalizing on natural phenomena like sea breezes. By strategically combining these approaches, developers can aggregate hourly-matched renewable resources to achieve a 100% green hydrogen supply within 45V regions, complying with the 2028 hourly matching rules.

Uncorrelated Sites: A Clear Advantage

The importance of selecting uncorrelated sites where wind and solar outputs complement each other cannot be overstated. As mentioned earlier, uncorrelated sites can produce up to 40% more hydrogen for the same CAPEX as correlated sites. This is a significant advantage, especially when considering the high cost of developing green hydrogen infrastructure. Additionally, optimizing the wind-to-solar ratio can further enhance economics, leading to CAPEX reductions of 1.9% at uncorrelated sites and 2.3% at correlated sites.

For green hydrogen developers, the key to success lies not in simply increasing renewable energy generation. Ultimately, the most efficient and economical approach is to select wind and solar sites that are uncorrelated and optimize both the wind-to-solar ratio and generation-to-electrolyzer ratio depending on the site-specific wind and solar resource. Meteorological data analysis and consideration of meteorological phenomena that decorrelate the wind and solar resource can therefore create advantages for the green hydrogen developer, or other developers seeking to maximize the covarying wind and solar energy production for any application (e.g. data center green energy utilization).